The Power of AI for Investing

- Sam Wocks

- Mar 25, 2024

- 4 min read

If you can harness AI, then you can revolutionize investing strategies.

In recent years, the world of finance has been buzzing with excitement about the transformative potential of artificial intelligence. As vast amounts of data become more accessible and computing power becomes more affordable, financial institutions are eagerly adopting these cutting-edge technologies to gain a competitive edge.

Imagine a world where algorithms can autonomously execute trades, adapting to market movements in real-time.

Imagine a world where robo-advisors can craft personalized investment portfolios tailored to each client's unique goals and risk tolerance. This is the promise of artificial intelligence in finance.

Artificial Intelligence is ideally suited to tackle the complex challenges of investing.

By analyzing massive datasets, detecting patterns, and continuously learning, these algorithms can provide unprecedented insights and make lightning-fast decisions. From algorithmic trading and portfolio management to risk assessment and derivative pricing, AI is reshaping every corner of the industry.

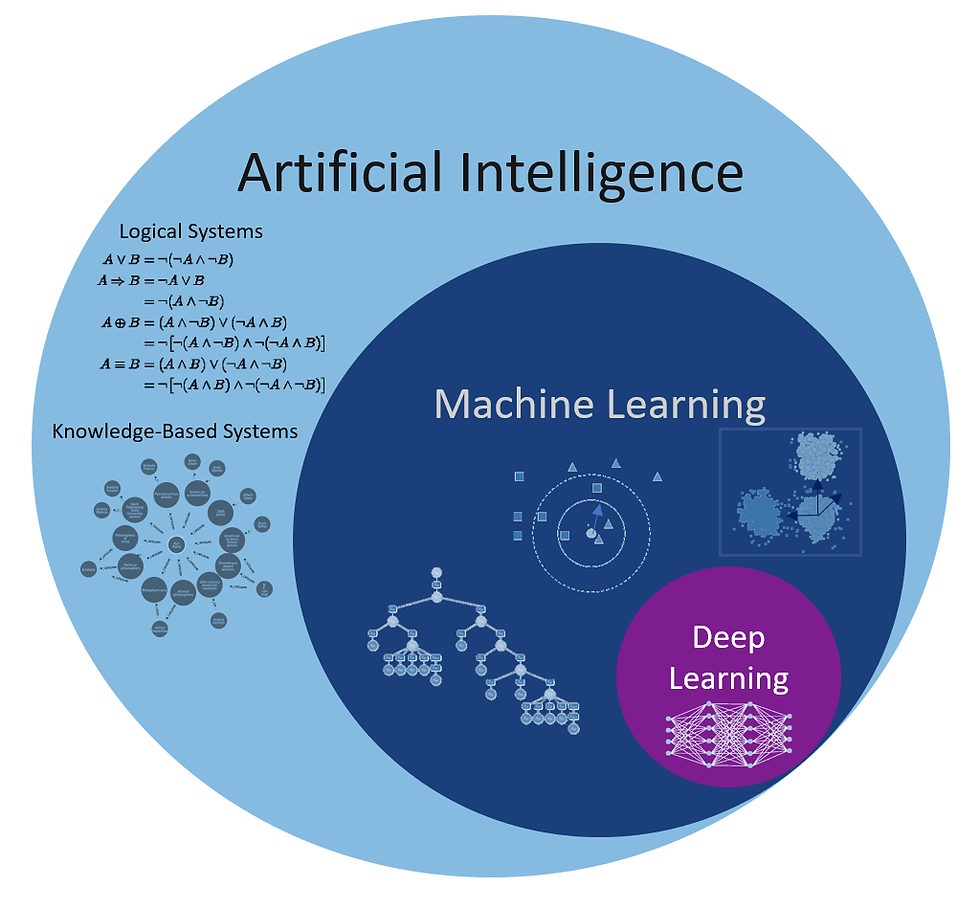

But what exactly is artificial intelligence, and how does it differ from other buzzwords like machine learning and deep learning?

Artificial Intelligence (AI) is the overarching field that encompasses the creation of intelligent machines capable of performing tasks that typically require human-like understanding, perception, and decision-making. It's a broad term that covers a wide array of technologies and approaches, all aimed at enabling computers to exhibit intelligent behavior.

Within the realm of AI, Machine Learning (ML) has emerged as a game-changing subset. ML focuses on empowering computers to learn and improve from experience without being explicitly programmed. It's all about feeding vast amounts of data into algorithms that can identify patterns, extract insights, and make predictions or decisions based on that learning.

Think of ML as a toolkit of various techniques, each suited for different types of learning tasks. Supervised learning, for instance, is like having a wise teacher guiding the machine through labeled examples, helping it learn to predict outcomes for new, unseen data. Unsupervised learning, on the other hand, is like setting the machine loose on a treasure trove of data, allowing it to discover hidden structures and relationships all on its own. And then there's reinforcement learning, where the machine learns through trial and error, receiving rewards or penalties based on its actions, gradually optimizing its decision-making strategies.

But the journey of AI doesn't stop there. Deep Learning (DL) takes machine learning to new heights, drawing inspiration from the intricate neural networks found in the human brain. By stacking multiple layers of artificial neurons, deep learning models can delve into the depths of complex data, uncovering patterns and representations that were previously unimaginable.

Imagine a vast network of interconnected nodes, each one processing and passing information to the next, forming an intricate web of learning. With each layer, the model can extract increasingly abstract and sophisticated features from the data, enabling it to tackle incredibly complex tasks like image and speech recognition, natural language processing, and even autonomous decision-making.

The power of deep learning lies in its ability to learn hierarchical representations directly from raw data, without the need for extensive manual feature engineering. It's like giving the machine a pair of super-powered glasses, allowing it to see patterns and connections that were once hidden from view.

In the grand scheme of things, AI is the overarching quest to create intelligent machines, while ML provides many of the tools and techniques to make that quest a reality. Deep learning, in turn, represents the pinnacle of ML, pushing the boundaries of what's possible and bringing us closer to the dream of truly intelligent systems.

So the next time you hear about AI revolutionizing an industry or solving a complex problem, know that it's likely machine learning and deep learning that are doing the heavy lifting behind the scenes. And as we continue to push the frontiers of these technologies, the possibilities are truly endless.

This blog series will delve into the fascinating world of AI in finance, exploring its immense potential. From predicting stock prices to enhancing risk management, the applications are virtually endless.

The true power of machine learning lies in its ability to continuously learn and adapt.

As new data emerges and market conditions evolve, these algorithms can refine their strategies and stay ahead of the curve. It's like having a team of tireless analysts working around the clock, constantly seeking out new opportunities and mitigating potential risks.

Of course, harnessing the full potential of machine learning in finance requires more than just algorithms. It demands a robust infrastructure, the right toolkit, and a deep understanding of the underlying principles. But for those who can master it, the rewards are unprecedented.

Key Takeaway:

AI is revolutionizing investing by empowering algorithms to learn from massive datasets, adapt to dynamic markets, and make split-second decisions, unlocking unparalleled opportunities for those who can harness its power.

At Precession AI, we began with a mission:

What if there was a way to leverage state of the art Artificial Intelligence to unlock patterns in financial markets that have remained elusive to traditional techniques?

The approach involves sophisticated algorithms capable of digesting vast datasets, including historical market data, global news, and social media trends, to reveal hidden market patterns that are not explainable by traditional economic logic. These statistical anomalies are difficult to detect yet not random. These 'ghost patterns' unlock a novel way to predict stock movements, and the results speak for themselves:

In initial tests, we've seen 3 AI strategies achieve astonishing 1 yr. returns

From 20-Feb-2023 to 20-Feb-2024

199.5% - on SPDR

630.8% - on TSLA

16,656,072.3% - on BIT/USD

To put these figures into perspective, the S&P 500 ETF returned 21.9% over the same period. The AI generated strategy profits were an incredible

9.1x, 28.8x, and 760.6x higher, respectively.

GET IN TOUCH

If you're interested in leveraging Precession AI's cutting-edge strategies for your investments, we'd love to hear from you.

Also, join our community to stay ahead of the curve with the latest insights on AI investing. Receive all news, updates, and articles directly to your inbox.

コメント